Compare various car insurance prices quote to make certain you're getting the finest feasible rate. As you obtain older, your car insurance premium need to go down, as you're taken into consideration much less of a threat.

For any type of responses or correction requests please contact us at. Sources: This content is produced as well as maintained by a 3rd party, and also imported onto this web page to assist individuals give their e-mail addresses. You may be able to discover more information concerning this and also similar material at.

You might pay more for insurance policy if you are a teen chauffeur or have a teenager operating your lorry. Just How Can You Decrease Your Car Insurance Policy Price?

The only time most of us assume about our auto insurance is when there is bad information, like a ticket or a crash. When you're young, solitary as well as incident-prone, rates just appear to go one way: up.

Trick TAKEAWAYSCar insurance premiums can boost for various factors, yet there are several points you can do to offset the increases. Some large life changes, like getting a home and getting married can decrease vehicle insurance policy expenses.

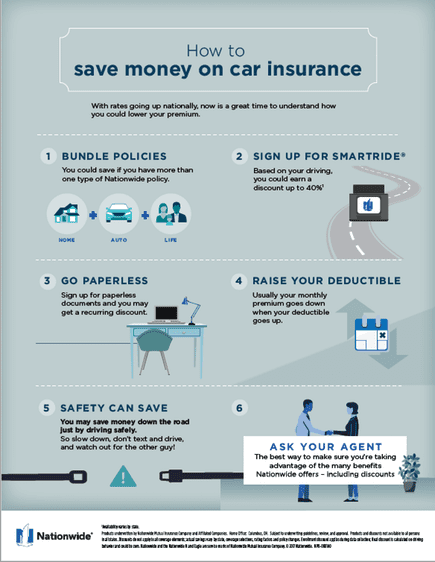

IN THIS ARTICLELife occurs: 16 methods to conserve on cars and truck insurance, If you don't desire to wait for your car insurance coverage rates to go down, the excellent information is that there are actions you can take today to save money on car insurance policy. Need to know even more? Right here are 16 different approaches to try.

What Age Does Car Insurance Go Down? - Progressive Can Be Fun For Everyone

Since you're older as well as smarter, you do not have actually to be stuck to the exact same high price. You do not have to stick with the same insurance coverage business (perks). Occasionally going shopping around for the very best bargain on vehicle insurance policy is a terrific way to pay much less. Today, it's simple to contrast quotes online.

Obtain price cuts for installing anti-theft devices, Car insurer are pleased to provide price cuts to consumers who take steps to reduce their risk as motorists (auto). One method to do that is by setting up gadgets that can hinder thieves or make your vehicle simpler to recoup if it is taken, such as an auto alarm or GPS tracking.

Insurance firms enjoy statistics, as well as data shows that married drivers get in fewer crashes. Also you wed a spouse that does not drive, your prices can still drop drastically around on average.

Ask your auto insurance provider what kinds of affinity group price cuts it uses. Miss monthly costs settlements, Establishing your cars and truck insurance policy premium to be billed month-to-month could be much easier to budget plan, however if you can afford to pay a larger portion at once, it can conserve you cash. low cost.

Buy a residence, Insurers take into consideration home owners extra steady than renters, so most will certainly discount your price, regardless of whether you insure your residence with them or not. The price cut amount will vary; country wide, it standards about. More significant financial savings come from packing your house and also automobile insurance coverage. The financial savings commonly are reflected in your automobile insurance coverage costs.

Relocate to a tiny community, If you determine to ditch the big city for a town with more area as well as fewer people, it might profit your cars and truck insurance coverage price, too. cheapest. Outside of your own driving record, couple of things have extra effect on car insurance than your ZIP code. Much less populace thickness usually suggests less accidents.

Everything about What Can Raise Or Lower The Cost Of Your Car Insurance- Aaa

It doesn't take place overnight, however it does happen, Big modifications in your life generally suggest big adjustments in your insurance coverage. "It's not typically one company will certainly offer the most effective sell all scenarios," states Dime Gusner, elderly consumer expert for Insurance coverage. com. That's why it's an excellent idea to shop about for insurance as well as guarantee you're obtaining the finest bargain.

Exactly how can I reduce my automobile insurance after an accident? The trouble is that if you're in an at-fault crash, or your insurer believes you've been associated with also numerous events, your insurance costs will likely go up. One at-fault case, as an example, can elevate your price anywhere from, depending upon the severity.

Sadly, your rate can still boost due to shedding a great driver discount. Just how much does car insurance coverage drop after 1 year without insurance claims? If you're a secure chauffeur and haven't submitted any type of claims in the in 2015, your cars and truck insurance rates might go down at renewal or may stay the very same. auto.

It's possible that your automobile insurance coverage premiums can go up also if you don't have an accident or make a claim during the entire plan term. When will my car insurance decrease? Insurance provider will frequently cut your rates when you turn 25, yet this is not constantly the instance.

cheap car trucks money credit

cheap car trucks money credit

If you're a risk-free driver, you can see a decrease in your vehicle insurance prices at policy renewals as well as costs may go down even prior to 25. Why did my insurance coverage decrease? If you've been with your car insurer for 3 or even more years, they might agree to offer discount rates that weren't noted throughout the quote process.

You may expect a rise prior to seeing a decrease in prices. Does vehicle insurance policy decrease in time? Yes, car insurance reduces over time. You might find that your car insurance rates drop as you age or have teen drivers aboard. As well as you may obtain discount rates if you secure insurance policy with the very same firm for three to 5 years.

Did Your Car Insurance Rate Increase Or Decrease? Here's Why. - An Overview

trucks auto insurance liability cars

trucks auto insurance liability cars

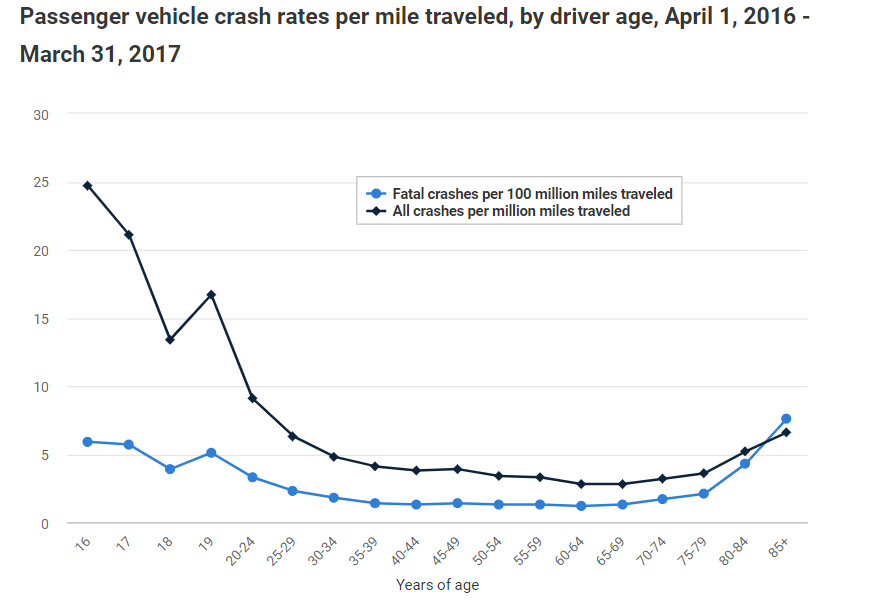

Exactly how car insurance policy prices are established, There are numerous key variables that are made use of by the insurance provider to figure out just how much you will spend for vehicle insurance policy. These elements consist of: Your age, The state you live in, Your driving record, Your credit history, The kind of automobile you have, Your marital condition, Generally, drivers under the age of 25 pay much higher costs than those who have actually reached this age (cheaper auto insurance).

Here is a break down of the typical price of automobile insurance coverage by age: New as well as teen vehicle drivers, Both more youthful and also older chauffeurs are statistically far more most likely to have a mishap than middle-aged chauffeurs, yet the accident price for teenagers is a lot greater than that for older chauffeurs. This is primarily why cars and truck insurance coverage is so costly for teenagers, and why having a teenager added to a moms and dad's plan can assist mitigate the price. auto.

By themselves policy, prices are commonly the greatest for 17- and 18-year-old motorists (vehicle insurance). Vehicle drivers in between 20 24During this duration, most drivers will certainly see peak costs progressively begin to decrease as they near age 25. While rates are likely reduced than those seen in the teenager years, the expense is still considerable, particularly at once when chauffeurs may likewise be managing independent living expenses or college tuition.

Drivers in between 25 55Drivers in this group remain in the "wonderful place" for insurance firms because they have built up driving experience as well as generally clear up in the reduced risk category of life scenarios. Car insurancerates for those in this age array are normally lower than they are for any type of various other age array. cheap auto insurance.

Exactly how to minimize the influence of age on your auto insurance policy prices, If you are still a teen or under the age of 25, there are numerous things that you can do to reduce the expense of car insurance policy - suvs. Here are a couple of that can have a significant impact on the cost of automobile insurance policy for young drivers: Lots of insurance providers will use a price cut to students who keep a particular grade point average, such as B or B+.

If you or your family members insures numerous cars under one service provider, you may see extra cost savings. This is especially valuable here if the driver can pay for insurance coverage for 6 months at a time.

The Ultimate Guide To Does A Lapse In Coverage Affect My Car Insurance Rates?

liability car low cost dui

liability car low cost dui

Especially suitable to college-aged chauffeurs. Other ways to minimize vehicle insurance coverage, There are additionally a number of various other points you can do to save cash on your auto insurance policy costs that do not depend on your age. A few of these activities consist of: Reducing or dropping your crash protection and also carrying just liability insurance coverage if you have an older vehicle. insurance.

There are a number of various steps that you can take to decrease your cars and truck insurance expenses when you are more youthful. Other things can be done to lower your automobile insurance policy no matter your age. Auto insurance policy is typically one of the most costly when you're young, but thankfully, time as well as experience normally minimizes prices.

Consult your monetary advisor or insurance policy agent for additional information on vehicle insurance coverage and what you can do to reduce your prices.

car insured auto vans insurance company

car insured auto vans insurance company

For numerous individuals, insurance is viewed as a complicated issue, especially when it concerns cars and truck insurance coverage for young grownups considering that they often tend to pay the greatest premiums of all drivers. As a result, among the most important concerns young individuals have on their minds regarding automobile insurance is, "Does automobile insurance policy decrease at 25?"Well, the brief solution to this question is of course.

So, just how much does car insurance go down after transforming 25? Every year of driving experience converts to lower automobile insurance prices. The suggestion behind this strategy by insurance companies is that as soon as drivers transform 25, they have sufficient experience behind the wheel to make them much less of an obligation; for this reason they are qualified to pay somewhat lower costs - cheaper car insurance.

If you are a 24-year-old, car insurance policy will cost you on ordinary 11% greater than when you reach 25 (cheap auto insurance). You need to additionally recognize that if you merely prevent any kind of regrettable cases while when driving and also obtain no web traffic offenses till you are 25, you will certainly remain in a far better placement when it concerns the automobile insurance coverage prices when you do turn 25.

Auto Insurance Discounts Can Be Fun For Everyone

When Does Vehicle Insurance Coverage Go Down? Educating oneself on the finer points of car insurance and also the difference that age makes in the amount one has to pay will make certain that you will take full benefit of the price cuts in vehicle insurance policy when the time is.

This is mostly since younger chauffeurs are statistically more prone to entering into an accident while when traveling. As a result of a high number of claims, they set you back the insurance provider more cash in residential or commercial property damages and also medical costs - auto. However, with time, young chauffeurs often tend to gain even more experience behind the wheel, which results in the insurance costs slowly reducing.

Age is no longer considered a factor that can influence auto insurance policy rates. Just how Much Does Your Vehicle Insurance Go Down When You Transform 25?

In fact, some young drivers that have actually already turned 25 will not see any type of modifications in all in terms of their insurance policy premiums, despite the benefits that turning 25 years of age brings. It is since they could drop right into the following categories: Inexperienced Motorists No matter just how old you are, your driving experience comes (accident).